Why does Quebec make us choose a bank based on which one sucks the least?

Upon meeting a new friend, one might be asked their astrology sign, how many siblings they have, or what they do for a living. It helps us get a sense of who a person is. What might be most telling, for Quebecers, is to ask which bank they use.

The Big Five make up most of the Canadian market share, so chances are, your new friend banks with one of the following: Royal Bank of Canada (RBC), Toronto-Dominion Bank (TD), Scotiabank, Bank of Montreal (BMO), or Canadian Imperial Bank of Commerce (CIBC).

Thanks to extensive mergers over the past few decades, these banks have become about as big as government institutions themselves. An international banking regulator called the Financial Stability Board determines which banks are global systemically important banks (referred to as G-SIBs, and domestically as D-SIBs). As of 2020, TD and RBC are still on that list, which also includes U.S. banks such as JPMorgan Chase and Goldman Sachs.

Lists like these are based on an economic theory that some banks become “too big to fail” (TBTF), when so much of the population relies on them to remain stable. G-SIBs and other banks the government decides, whether explicitly or implicitly, are TBTF, are regulated to “maintain additional capital buffers” and “discourage banks from becoming even more systemically important,” according to the Bank for International Settlements (BIS). They are also high-profile enough that in an economic recession, or even a forecast of a recession, the government becomes pressured to become their guarantor.

Mo’ Money, Mo’ Problems

Logically, it seems like if a big bank has so much money, it would be the safest place to be during a recession. Sometimes that’s true. The fact that our banks are so large and diversified made them some of the most stable banks in the world, as ranked by Global Finance Magazine in their annual stability report. But sometimes it makes it riskier.

Once big banks get TBTF status, they have virtually unlimited protection from the government. Given they are still businesses trying to make as much money as possible, they are prone to make riskier moves, leading to higher likelihood of more government bailouts.

Don’t like the fact that your tax dollars would be bailing out a company that rakes in a couple billion dollars each quarter? Maybe you do. It’s partially what makes our banks so stable.

Others can’t get down with it. Given the fact that our banks are very stable, most Canadians believe they aren’t in need of government assistance. Many journalistic efforts have been published, including pieces by the Financial Post and the Canadian Centre for Policy Alternatives. Most of these pieces are merely estimations based on public funding, such as pension funds and individual welfare checks. Some have even cited CERB as an implicit government subsidy for people’s pandemic-related bank struggles.

Employee-led research from the Bank of Canada arguing against TBTF cites that along with increased market power, gaining TBTF status was the driving force behind major bank mergers and the formation of the oligopoly we know and love today. While at the G-SIB level, they are subject to global regulations putting caps on profits, they are more likely to receive implicit support when the economy struggles.

Like any good government organization, our big banks have their flaws. You might wait forever, or be helped pretty unhelpfully. You might wonder why your bank doesn’t give a hoot that you’re funding their business with literally all the money you have.

Bank mergers are a major reason why we pay way more for our banking privileges, compared to the United States. Down south, you can almost universally expect to bank for free, and earn a decent interest on your savings account. That’s due to their more fragmented system, which creates more competition between large and small banks, leading to lower rates. Our Big Five are the result of major mergers of medium-sized banks seeking more market power. They now dominate the Canadian market and charge us the fees to match.

Another downside to the oligopoly is that no matter what, money in your bank account is funding a company that can put money in whatever they choose, regardless of their clients’ politics. As CBC reported earlier this year, RBC is among the top five banks worldwide involved in fossil fuel financing, with over $160 billion lended out between 2016 and 2020. Reasons for not pulling out, if any, would be fear of disrupting the Canadian economy, which is heavily reliant on the fossil fuel industry, according to CBC.

As of November 2021, all Big Five will sign onto a new international agreement, the Glasgow Financial Alliance for Net Zero (GFANZ), according to CBC. While the goals of this new agreement include prioritization of “green” investments and lowering emissions of bank clients, signatories of the plan need not to withdraw from ongoing funding projects in the fossil fuel sector. Climate activists have warned the public not to start celebrating until those withdrawals are made.

Finding My Bank Soulmate

Ever tried joining a new bank in Quebec? Maybe you’ve just been with the same one since you were 14, like I had. When I first moved to Canada four years ago, I just went to the one that was closest to me. After three years, I started noticing how much I detested it. Some people do all their banking online, but I’m more high-maintenance than that.

My bank never answered the phone, and when they did they would respond with long scripted responses. At the branch, they looked at me with disgust when I approached their counter, they held my checks for days on end. I didn’t feel wanted.

Since my broke beginnings while growing up in the States, I’ve held an account at a credit union, not a bank. If you’re a true Quebecer, you’ll know it as the “caisse-populaire,” associated with the Desjardins group. Credit union, caisse-populaire, potato, potate. Same thing? You could say so. I’ll share my American experience first.

Close your eyes. Imagine a world just like your own. Maybe a tad warmer. Imagine you call your bank and they pick up right away. Imagine they speak with you like a friend: They ask you about your day, and give you all the platonic intimacy you deserve. Imagine you hang up the phone feeling satisfied and reassured that your request has been diligently honoured.

Imagine your account is free, no matter how much is in it, and when you walk into a branch, at least three individuals await you with a smile, and even if they have filing to be done, you, a member, are their top priority. Open your eyes: that’s what a credit union feels like.

Upon making the decision to leave TD after three years — a bank I highly do not recommend — I looked endlessly for another bank with this level of devotion. Unfortunately, I don’t think it exists in Canada just yet.

When inquiring on what bank is best to turn to, most reddit users recommended Tangerine, one of the only online banks available in Quebec. Formerly known as ING Direct, it has since been acquired by Scotiabank, but still operates as a separate company. Due to the lack of in-person branches, it’s free for everyone, and has some of the best rates for high-interest savings accounts. It seemed like my only option. At the same time, if I did turn to Tangerine, I’d be going from unpleasant, in-person branch visits, to no branch visits at all. Is that what I really wanted?

I quickly realized that what I was looking for was not a bank, but a credit union, just like I had back home. The peak difference between a bank and a credit union is that a bank is for-profit, and a credit union is not-for-profit.

A credit union is like your local co-op grocery store. As a member, you are part owner and participant in the union, in turn taking advantage of low rates and high quality service. A bank is a business set out to make profit and satisfy shareholders — the reason for usually much higher rates.

Did you ever notice that while a credit union has more of a “you’re one of us” attitude, a bank has more of a “you need us, we don’t need you” attitude? Maybe not. That’s because unlike every other Canadian province, in Quebec, Desjardins is basically just another one of the Big Five. Actually, if you considered it a bank, it would knock CIBC right out of the Big Five club.

Caisses Un-Populaires

Time for the tea you all came for. Let’s talk about credit unions in Quebec: a concept that has a history tied to the very beginning of credit unions in North America.

Desjardins is our one and only caisse-populaire in Quebec, founded in 1901 by a Mr. Alphonse Desjardins as the first credit union in North America. Just seven years later, Desjardins and a group of French-speaking immigrants opened the very first credit union in the United States, which is now home to well over 5,000 of them, as of 2021.

So why is Quebec left with only one? And why does Desjardins play along like they’re just another one of the Big Five?

If you search the term “caisse-populaire” in Wikipedia, you’d be redirected to the Desjardins Group, made up of numerous investment firms, real estate holdings, and brokerages. It’s also the proud owner of many Canadian expansions of U.S. insurance giants such as State Farm (since rebranded to Desjardins Insurance). Does any of that remind you of your friendly neighbourhood gardening collective?

During my search for a new financial soulmate, I actually found exactly what I was looking for. It was a credit union (duh), whom I called and was immediately connected to a friendly customer service woman. The conversation was refreshingly friendly and easy, like talking to an old friend. I felt strongly that this union was the place for me: a perfect match. The representative then explained that membership was not available in Quebec, due to some regulations. She encouraged me to call back in a year, though, to see if the law had changed. A law that possibly hadn’t changed since 1901?

Since I couldn’t find any answer for this online, or an alternative credit union in our province, I nearly gave up. Every article I found was talking about how cool and hip Desjardins was, so I decided to check it out for myself. Maybe I would make this my bank after all.

When I got there, I felt like I was back at TD. The computer was so slow, and after 5 minutes of dial-up style loading speed, I was told I couldn’t get an appointment for another four hours (even though I was the only one there). I knew there was an advisor upstairs holding her breath, because I heard her sneeze right before leaving.

I went back to my trusty sidekick, Google. I suddenly found myself reading words like “…the authority shall establish…” on the Quebec government’s open source website, and discovered nothing further.

It Really is Quebec’s Fault

I spoke with Professor Moshe Lander, a senior lecturer in the Economics Department at Concordia, who has at least 20 years of experience teaching on the subject.

As I quickly discovered, one thing Google can’t explain is the vast, black hole that is the relationship between Quebec’s history and its modern economic regulations. It might be something that goes right over the heads of Quebecers who have never lived anywhere else, and only be a problem for those of us who have migrated from other provinces or countries.

When we ask questions like, “We’re a part of Canada, so why don’t we get what everyone else has?” the answer almost always has something to do with our provincial government.

You see, the Big Five aren’t affected by Quebec laws. Banks are regulated by the federal government. Credit unions, on the other hand, are regulated provincially.

My first assumption was that there was a distinct law mentioning Desjardins as the only credit union allowed to operate in Quebec. In fact, the situation is purely circumstantial.

According to Professor Lander, after 120 years of operation, Desjardins has a monopoly over our province, making it hard for outsider credit unions to gain traction here. “It’s not worth it [for them],” he said.”Tack on all of the language requirements, the different legal system […] getting your foot into Quebec is almost impossible.”

It seems that the province’s unique legal system is what keeps a lot of that cool stuff out. “Just take a look at fast food restaurants,” Lander began. “Swiss Chalet doesn’t exist here. St. Hubert exists here, because the legal system is different. So, in terms of product liability, consumer protection, disclosure requirements… For a privately-held company it’s different.”

Professor Lander said these provincial differences also extend to the banking and financial sector. Credit unions such as Vancity in British Columbia, and motusbank in Ontario, can operate in any other Canadian province, since their legal and regulatory systems are similar, but not in Quebec.

One other reason that this problem might be specific to credit unions is the very fact that they are only as big as their clientbase. Lander said that both the non-Quebec credit unions and Desjardins would not seek to maximize their client-base all across Canada for the same reason. “Because [credit unions] are not a private company that’s looking to maximize shareholder value, [they] are ultimately owned by [their] customers,” he explained.

So, when the operator from the Ontarian credit union I spoke with before said, “if something changes in a year, call us back,” she probably wasn’t talking about a change in Quebec regulations. Most likely, she was talking about a change within their company that would drive them to begin doing business here.

Furthermore, it doesn’t help that Quebec is pretty much a ghost town compared to the United States. Our population is just a fraction of the size. That’s probably why Desjardins doesn’t offer the hottest rates or the hottest service ⏤ with their member numbers being just as low as a mid-size niche credit union in the United States, they can’t afford to offer Quebecers a better rate than any of the Big Five.

As for the lack of choices to overall banking methods in Canada, it’s actually a federal problem. Professor Lander attributes this to both population size and lack of regulations over mergers between banks, unlike the U.S. which regulates inter-state transactions. As for Canada, “Through mergers, [big banks] basically came to swallow up everybody underneath them, and left nothing behind. That sort of concentration hasn’t taken place in the U.S.,” he said.

“Even if you take the biggest banks in the U.S., [such as] Bank of America, they don’t add up to 95 per cent of the deposits or mortgages and loans. It’s a much more fragmented system,” he said. That also explains why Desjardins became a monopoly across the province, which was once home to many small, local credit unions.

As it turns out, you can assume that it’s all loosely attributed to the war between the French and the English that took place 350 years ago. That’s what makes us special. As Professor Lander noted, “It drives a huge amount of product law and business law and these oddities that just don’t exist elsewhere in North America.”

It seems things won’t change until the nicer credit unions take a leap of faith across provincial borders, or our government does a major ego-check. For now, we’ll have to choose between the bank that sucks the least, or keeping the cash under the mattress.

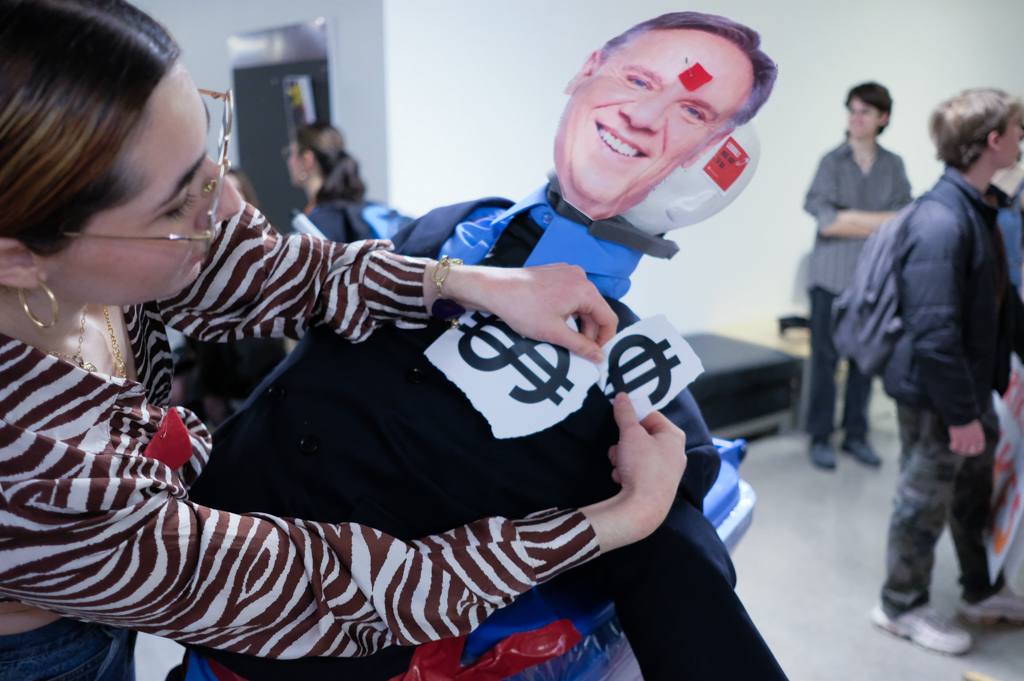

Visuals by Lily Cowper