A hilariously well-networked class reignites the fossil fuel divest movement

Since the formation of Divest Concordia in 2013, the student-run group has been continuously pressuring the Concordia University Foundation (CUF) to freeze current investments in the fossil fuel industry and withdraw all future investments from the top 200 fossil fuel companies. The CUF makes all decisions regarding the university’s $185.9 million endowment fund, which is invested in various stocks and bonds that generate funding for scholarships, bursaries and research coming out of Concordia. Approximately 10 per cent of the endowment fund “may have some connection with fossil fuels,” according to former University Spokesperson Mary-Jo Barr.

Research and mobilization around the divest movement has largely been undertaken by student-run groups like Divest Concordia, Sustainable Concordia, and the Concordia Student Union (CSU) in 2016, when the CSU adopted divestment as their annual campaign. However, in January 2019, a group of students enrolled in a 400-level interdisciplinary geography course began brainstorming ways to utilize the class’s resources and networks to reignite the divest movement at Concordia.

“It’s a methodology class where students learn about how to do research that supports, and is engaged with the work of a social justice institution,” said Kevin Gould, an associate professor in the geography, planning and environment department, who created the shell of the course. “The class has become a space where people that have this common interest [of divestment] have been able to engage with each other—to learn, to think, to plan,” said Gould. Students are currently in the early stages of developing scopes of research that examine potential avenues for furthering the divestment movement on campus.

Emily Carson-Apstein, who works closely with Divest Concordia and is the external campaigns coordinator for Sustainable Concordia, was a key member in helping Gould structure the class around divestment. Carson-Apstein said that having the CSU campaigns department working with Divest Concordia meant there was a lot of people-power behind the movement. “[The divest movement] is smaller than it was in 2016 […] but it’s definitely still present,” they said. “It’s more in a negotiation phase than a public education phase.”

Increasing student awareness of the urgent need for full fossil fuel divestment, community mobilization and conveying the message that Concordia is not an institution completely committed to a sustainable economic future are a few of the goals the geography class hopes to help Divest Concordia with.

In 2014, Concordia boasted the creation of a socially responsible investment (SRI) fund of $5 million, which would transfer funds from existing assets to be reinvested in “environmental, social and corporate governance (ESG) factors,” according to the university’s website. Divest Concordia representatives at the time condemned the foundation’s decision, saying it was “a flat-out rejection of student calls for full divestment from fossil fuels,” according to Newswire. Noting the distinction between sustainable investment versus fossil fuel divestment is pertinent, as sustainable investment is used as a redirection tactic to avoid addressing the foundation’s continued investment in the fossil fuel industry.

Despite heavy criticism from Divest Concordia, Concordia was praised by some of the wider Montreal community for exhibiting sustainable leadership. The Montreal Gazette published an article on Dec. 2, 2014 claiming that Concordia was the first university in the country to begin taking steps towards divesting from fossil fuels. However, it is important to note the CUF is able to continue to invest in the fossil fuel industry while simultaneously contributing to the SRI fund, as well as other sustainable investment endeavours. In February 2016, the foundation created the Joint Sustainable Investment Advisory Committee (JSIAC) in response to increased pressure from Divest Concordia, Sustainable Concordia, and the student body to fully divest. Divest Concordia and Sustainable Concordia each occupy a seat on JSIAC, and the committee is the only channel of communication either organization has to the foundation’s board of directors. JSIAC’s influence over the board and its investment decisions regarding the endowment fund ends at making recommendations to the foundation.

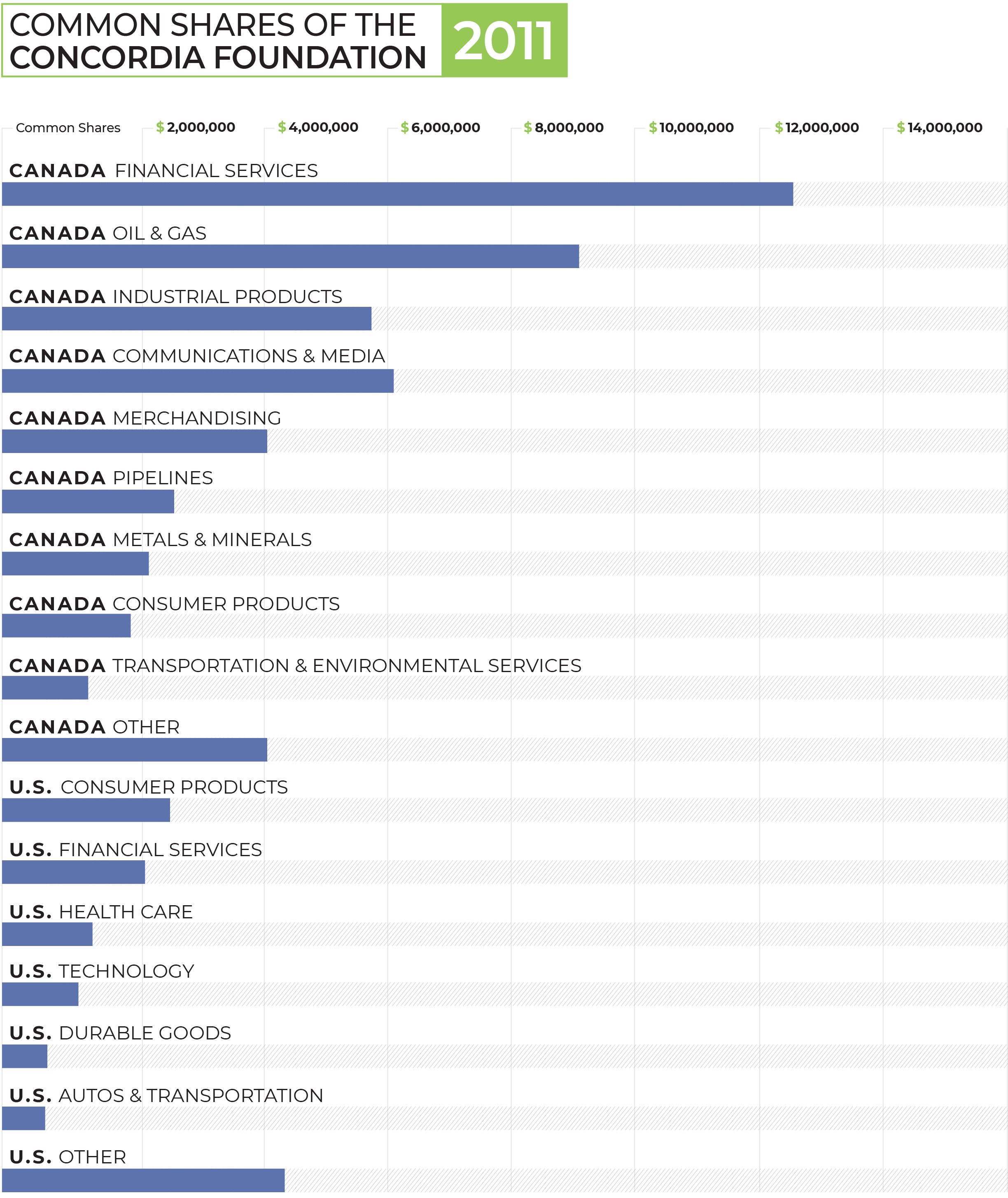

In an interview with The Concordian, Carson-Apstein stated that the yet-to-be released 2018 annual report estimate of the endowment fund is approximately $218 million, from what the CUF has informed Divest Concordia. In terms of financial transparency, the foundation has continually failed to clearly state which sectors of the economy it’s invested in since 2011, particularly with regards to energy resources. According to the foundation’s 2010-11 financial report, Canadian common share investments in oil and gas were about $9.1 million, investments in pipelines were about $2.6 million, and investments in metals and minerals were about $2.2 million.

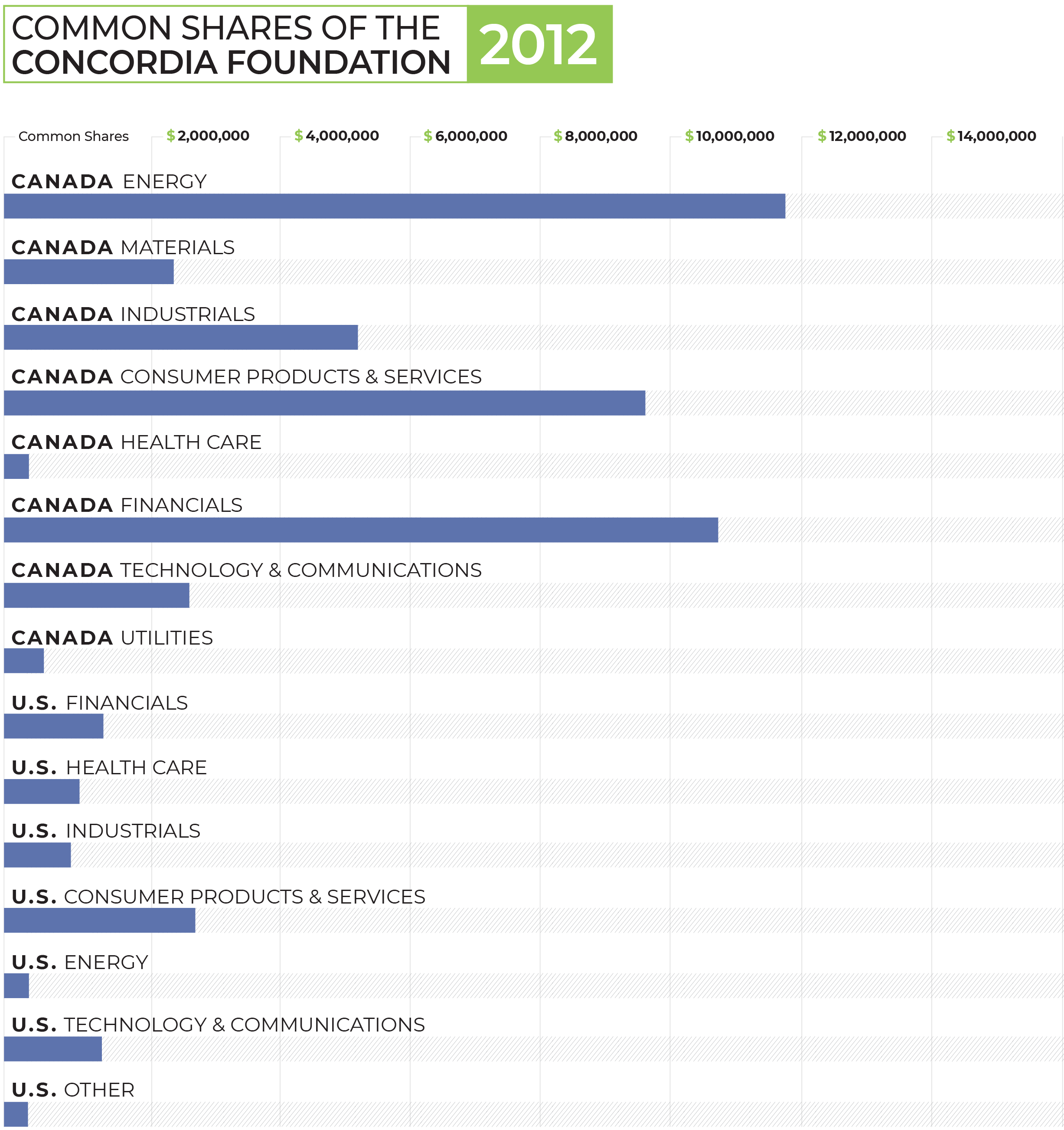

However, in the foundation’s 2011-12 annual report, categories such as ‘oil and gas,’ ‘pipelines,’ and ‘metals and minerals’ cannot be found in the common share investment breakdown. Instead, the report vaguely shows an $11.7 million investment in the relatively ambiguous category titled ‘energy.’ According to the foundation’s 2016-17 annual report, a total of about $10 million in both Canadian and U.S. common share investments fall under the categories ‘energy,’ ‘materials,’ and ‘industrials.’ On Feb. 11, 2019, Concordia announced it is the first Canadian university to issue a $25 million sustainable bond, due by 2039, which will allow the university to finance the new Science Hub at Loyola. However, there have been no discussions of the more than $10 million continued investment in what is arguably the fossil fuel industry.

Carson-Apstein explained that a major challenge faced by Divest Concordia over the years has been institutional memory; the passing down of information and strategies from graduating students to newly engaged students. “Most of the folks who were founders of Divest Concordia have moved on by now,” they said. “But I think Kevin’s class is amazing […] It’s super cool that the work that’s happening in the classroom is going to be directly relevant to stuff that’s happening in the world right now.” Drawing attention to the discrepancies and financial patterns of the foundation’s annual reports is one of many strategies the geography class will use to shed light on the realities of Concordia’s investment practices, and continue pushing for full fossil fuel divestment.

Divest Concordia meets every Monday at 4:30 p.m. to discuss news, ideas and strategies. Meetings are held at 2090 McKay St. in the Z Annex on the top floor for anyone who wants to join the fight.

Feature graphic by @sundaeghost